List of Federal Rights Often Violated

- We all have the same natural Rights which are protected by the guarantees in our Constitution.

- Service Members and Retirees have certain Rights established by contract and federal law.

- People with disability have some additional rights established by the ADA and related laws.

- VA and SSA beneficiaries have a couple more established by their decisions.

VA Beneficiary

- 38 U.S.C. § 5301 establishes a Right to protection of Title 38 benefits from assignment or attachment by any legal or equitable process whatever.

Current spouses are considered dependent beneficiaries, therefore may have rights to VA claim, but the state cannot grant federal rights to a person who cannot possibly be a beneficiary. - 38 U.S.C. § 511 establishes a Right to protection of Title 38 benefits by the expressed preemption of all jurisdiction to review any part of the VA decisions, to assign or attach the benefits, to undermine the authority of the VA, or to interpret any part of Title 38 law.

- 38 U.S.C. § 511 establishes a Right to protection from review of the FACT of "Disability" established by VA decisions.

- 38 U.S.C. § 511 establishes a Right to the complete Privacy of every VA claim file. States have NO jurisdiction to use the information, therefore NO jurisdiction to probe the file.

- 38 U.S.C. § 511 establishes a Right to the complete Privacy of Medical Records associated with VA claims. Attempts to gain access to the records, or list the "disabilities" rated by VA, also violate the Rights established by the ADA and HIPAA.

- Any other act of fraud to get around the Positive Law Federal Preemption is a de facto violation of the Rights covered by Preemption.

- State Law has no effect on Positive Law or Federal Preemption of State Jurisdiction.

SSA Beneficiary

- 42 U.S.C. § 407(a)cl.1 establishes a Right to the protection of ALL SSA benefits from assignment by any legal or equitable process whatever.

Current spouses are considered dependent beneficiaries, therefore may have rights to SSA dependent benefits, but the state cannot grant federal rights to a person who cannot possibly be a beneficiary. - 42 U.S.C. § 407(a) CL. 2, establishes a Right to protection of ALL SSA benefits from attachment or garnishment because the connection between § 407 and § 659 ONLY deals with "garnishment" and has NO effect on the anti-assignment clause of § 407.

Section 659 explicitly defines “legal process” as “in the nature of garnishment” NOT as “in the nature of assignment.” - 42 U.S.C. § 405 establishes a Right to protection of ALL SSA benefits by the expressed preemption of all jurisdiction to review any part of the SSA decisions, to distribute the benefits, to undermine the authority of the SSA, or to interpret any part of 42 U.S.C. § 407.

- 42 U.S.C. § 405 establishes a Right to protection from review of the FACT of "Disability" established by SSA decisions.

- 42 U.S.C. § 405 establishes a Right to the complete Privacy of Medical Records associated with SSA claims. States have NO jurisdiction to use the information, therefore NO jurisdiction to probe the records.

It is an act of discrimination by predatory harassment to attempt to gain access to the records, or to list the "disabilities" evaluated by SSA. It is also a violation of the Rights established by the ADA and HIPAA. - Any other act of fraud to get around the Federal Preemption is a de facto violation of the Rights covered by Preemption.

- State Law has no effect on Federal Preemption of State Jurisdiction.

Anyone with Disability

- Americans with Disabilities Act (ADA) 42 U.S. Code CHAPTER 126, establishes the Right to Enforce the Equal Protection of Law, so we can deal with Discrimination when it happens.

The definition of “Disability” found in 42 U.S.C. § 12102 includes ANY impairment, of ANY kind, to ANY degree, and for ANY reason, whether it is visible or not. Thus, EVERY separate condition rated by the VA meets that definition without further inquiry.

It is a violation of the Right established by the ADA to say that it does not apply to veterans. - A person with disability may have a Federal Right to court appointed attorney, even for civil matters, because VA and SSA benefits cannot be assigned as income to justify an "ability to pay" anything, including attorney fees or court costs.

As a result, he or she may not be able to afford an attorney, BECAUSE he or she is Indigent as a direct result of being Disabled.

The ADA and Fourteenth Amendment support the claim of this Right because people with disability are especially vulnerable to predatory fraud and discrimination by experienced, professional attorneys and judges who are acting with prejudice.

This is distinct from Turner v. Rogers, 131 S. Ct. 2507 (2011) because the Turner Court did not effectively address whether disability caused him to be indigent, or whether he had a Right to counsel based on disability.

Active and Retired Military

- The Active or Retired Military Service Member has an exclusive Right to all Pay, Allowances and Benefits provided under the Terms of the Contract between the Government and the Service member.

This Contract is governed by Positive Law US Code Title 10, with pay and allowances defined in Positive Law US Code Title 37.

States have NO possibility of jurisdiction to "creatively interpret" the Positive Law which defines Active and Retired Military Pay, Allowances and Benefits.

Federal law specifies exactly how state authority applies to military pay in Divorce, alimony and child support proceedings.

This includes the Definition of "Pay" which may be treated as income for support orders and the possible division of Disposable Retired Pay as property in Divorce.

Active and Retired Military Pay is explicitly defined in 37 U.S.C. § 101(21)

'The term “pay” includes basic pay, special pay, retainer pay, incentive pay, retired pay, and equivalent pay, but does not include allowances.'

"Disposable Retired Pay" is explicitly defined in Uniformed Services Former Spouses' Protection Act (USFSPA), 10 U.S.C. 1408), with expressed federal preemption of state jurisdiction regarding disability benefits. See Mansell v. Mansell, 490 U.S. 581 (1989) and Howell v. Howell, 581 U.S. ___ (2017). - The Retired Military Service Member has an exclusive Right to all "Combat Related Special Compensation" (CRSC) which is explicitly separated from Retired Pay by 10 U.S. Code § 1413a (g) "Payments under this section are not retired pay."

- The Retired Military Service Member has an exclusive Right to all Title 38 Veterans Benefits because they are totally exempt from state jurisdiction.

- State Law has no effect on Positive Law or Federal Preemption of State Jurisdiction.

Everyone

- Civil Rights Act, found at 42 U.S.C. § 1981, et seq. establishes a Right to protection from discrimination based on sex (gender).

Corrupt state actors always seem to find a gender-bias excuse to strip the veteran of parental rights and contact. This happens automatically for both men and women veterans.

This is what makes it veteran specific sex discrimination to use the children as leverage to extract money from protected benefits. - The Health Insurance Portability and Accountability Act, Pub. Law 104–191 (HIPAA) establishes a Right to the Privacy of Medical Records.

Whenever corrupt attorneys, officials or judges order the SSA or VA beneficiary to open medical records, or use contempt to force the issue, it is a violation of HIPAA and the ADA by discrimination with intent to humiliate and manipulate the individual.

Whenever they say it is not a HIPAA violation, that IS a violation.

For a list of Positive Law Titles and citation of law that established them, see United States Code: List of Positive Law Titles With Enacting Cites and Location to Revision Notes (last rev. 2017) published by The Law Librarians' Society of Washington, D.C. (LLSDC) online at https://www.llsdc.org/

Positive Law takes precedent over "legislation from the bench" and Federal Preemption removes Judicial Immunity for the violation of Rights by legislation from the bench.

The Question of Immunity is Answered by Federal Preemption

It is very hard to sue a judge for money because they have “Immunity” for almost everything, but it is not hard to sue for Due Process because Declaratory and Injunctive Relief do not concern Immunity.

Immunity ONLY applies to “judgments for money” IF the state actor is doing something within their jurisdiction.

When is it clear they have stepped outside of the box of their jurisdiction, they can be sued for money because they have No Immunity where they have NO Jurisdiction.

“Legislation from the bench” is basically the “creative judicial interpretation” of law by "adding or removing words or ideas."

"Concurrent Jurisdiction" is what corrupt state judges use to legislate from the bench when the federal law does not fit their prejudice.

Positive Law takes precedent over "legislation from the bench" and Federal Preemption of State Jurisdiction removes all Immunity for the violation of Rights under the color of state law by legislation from the bench.

When they use fraud to get around Preemption, it is a de facto violation of the Rights covered the preemption. It is completely outside the possibility of jurisdiction, so they forfeit all immunity.

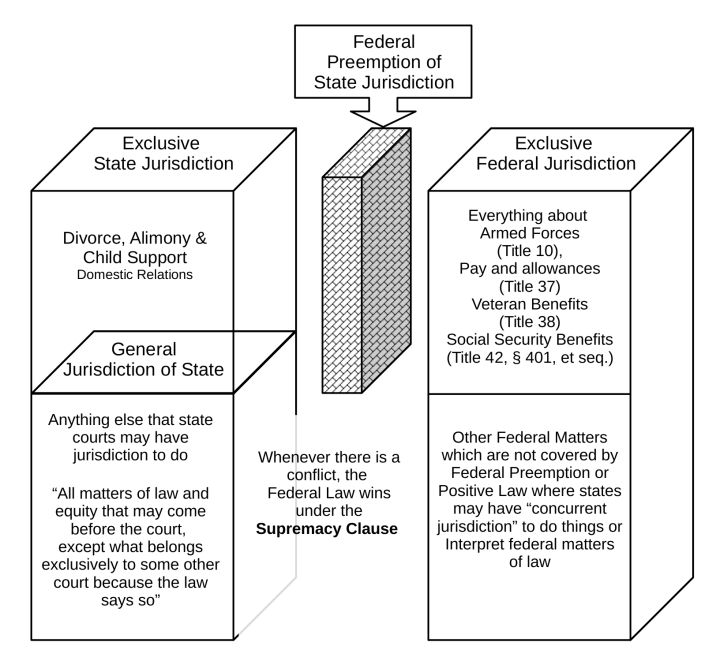

About Federal Preemption

Federal Preemption of State Jurisdiction means that certain things in federal law are totally exempt (-empt) from state jurisdiction before (Pre-) anything else.

State Law cannot overcome federal preemption, no matter what any state judge says. The Supremacy Clause removes all conflict between federal and state law in favor of the federal law.

In other words, State law cannot create jurisdiction where federal preemption has already canceled it.

The purpose of Federal Preemption is to remove "Immunity" for the violation of Rights under color of state law by removing the possibility of "concurrent jurisdiction" on certain federal subjects.

The result is "the complete absence of all possibility of state jurisdiction."

This means we can sue them for money because they have no immunity where they have violated our Rights with absolutely no possibility of jurisdiction.

Positive Law means the words of the law are not subject to "legislation from the bench" because they stand as “legal evidence of the law” (1 U.S.C. § 204) which Proves the Intent of Congress.

This is a form of Federal Preemption because, no matter what anybody says, Positive Law is the ruling of Congress over top of anything the courts might say.

It takes precedent over case law, especially old case law that has been superseded.

This also helps prevent federal courts from trying to use garbage case law to violate the intent of Congress expressed in the words of the positive law.

Judicial Immunity is supposed to protect the stability of our legal system.

Federal Preemption is there to protect the integrity of our legal system by removing Immunity.

Positive law proves Congressional Intent to keep things in line.

State actors have no possibility of "concurrent jurisdiction" to interpret any federal statute covered by Federal Preemption and/or Positive Law.

About Jurisdiction

A really simple definition of Jurisdiction is the authority to solve problems by making decisions based on the law and to explain what the law means when it is hard to understand. This explanation is called "Interpretation."

Divorce, alimony and child support are usually handled by state courts of "general jurisdiction." These courts may handle lots of different things on different days, but when they are working on family matters, they have no authority to make interpretations or decisions on things outside of the family matters.

Disability, for example, may affect the income and lifestyle of the family, but is not under the "subject matter jurisdiction" of divorce or child support, therefore not for the family court to decide. The same court might have jurisdiction on the subject of State disability claims on a different day, but "lacks jurisdiction at the moment" while in a family law case.

On the other hand, some things will never come under state jurisdiction because of "Federal Preemption of State Jurisdiction."

A common example of that is where federal law specifically says that Bankruptcy belongs to a specific federal courts at the District level, therefore state courts have no power to "interpret" the federal law or make bankruptcy case decisions. Even when family support matters might affect bankruptcy, they have to get permission from the bankruptcy court to work on support issues.

Likewise, the "subject matter jurisdiction" on "disability" established by DOD, VA or SSA decisions, permanently belongs to federal authorities and federal courts exclusively, forever. States cannot touch the legally established FACT of "disability" or the medical conditions involved in DOD, VA and SSA decisions because (subject matter) Jurisdiction is Preempted.

It does not matter what any state law says, or what any state court has ever said, Federal Preemption means that certain things NEVER enter state jurisdiction, at any time, for any reason.